Frank Calabrese, former Cook County Board of Review employee and whistleblower, has raised concerns about potential fraud and corruption in the county’s property tax system. | X / Frank Calabrese

Frank Calabrese, former Cook County Board of Review employee and whistleblower, has raised concerns about potential fraud and corruption in the county’s property tax system. | X / Frank Calabrese

A former Cook County Board of Review employee has blown the whistle on what he's calling "fraud" in the county’s property tax system.

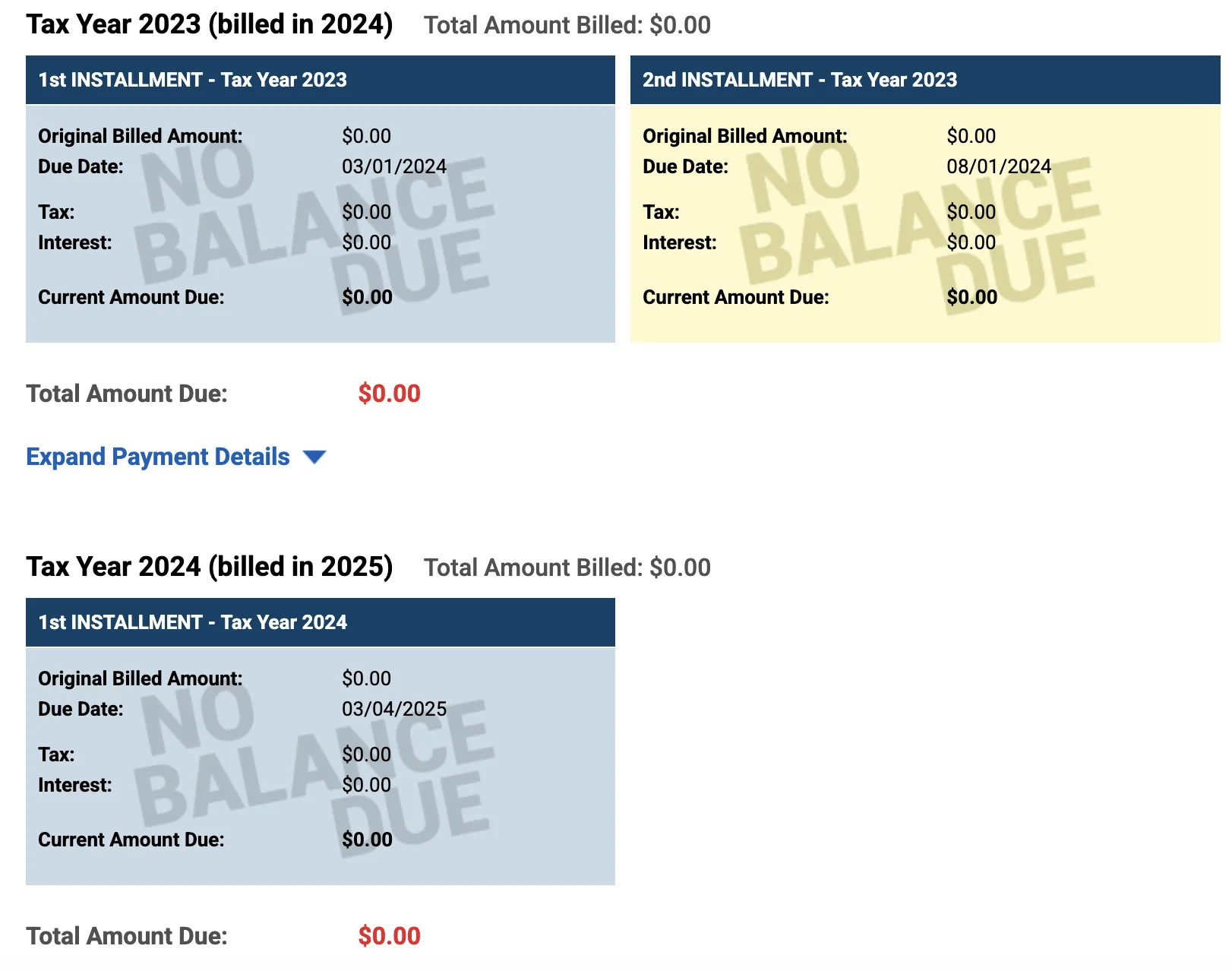

Calabrese, who previously worked for the independent agency that hears appeals and may adjust property assessments set by the Cook County Assessor, pointed out in a post on X that a property at 729 S. Summit Street in Barrington paid $0 in property taxes.

“How much does this $1.5 million house pay in property taxes? $0. Why? Fraud,” Calabrese wrote on X.

Property tax bill for a $1.5 million mansion located at 729 S. Summit Street in Barrington.

| Cook County Assessor

Property records show the home was purchased for $1.125 million in 2021 and has since grown in value to over $1.5 million.

However, a "Senior Exemption"—typically granted to residents over 65 who have lived in their home for years and meet certain income limits—was applied, eliminating the tax bill entirely.

“A $19k ‘senior freeze discount’ was applied that could only be available to ~100 year old who lived there their entire life,” Calabrese wrote.

According to public records, the $0 owed in property taxes for 2023 is "$24,871.00 less than 2022."

In 2022, the owners received a rebate after a successful appeal to the Cook County Assessor’s Office.

While the Assessor’s Office defended the application of the Senior Exemption, it acknowledged the property’s tax bill should not have been reduced to zero.

“We reviewed this case after it was brought to our attention,” Angelina Romero, Chief Communications Officer for the Cook County Assessor’s Office, told North Cook News. “The property owner is eligible for the exemptions they received, including the Senior Freeze, but should not have received a $0 tax bill in Tax Year 2023.”

“Going forward, the exemption will be amended to reflect a corrected Equalized Assessed Value and a corrected tax bill. The Assessor's Office has an Erroneous Exemptions department that reviews cases in which homeowners applied for exemptions for which they were not eligible. This department processes thousands of cases every year. In FY 2023, the department collected approximately $5.4 million in erroneous exemption cases, more than recouping its own operating budget.”

North Cook News reached out to Cook County Treasurer Maria Pappas' office about the case but did not hear back as of press time.

The property tax elimination followed an appeal by attorney James Sarnoff of Sarnoff Property Tax, formerly Sarnoff & Baccash, a firm known for securing major tax reductions during the tenure of former Cook County Assessor Joseph Berrios, who also served as Chairman of the Cook County Democratic Party.

A 2018 investigation by ProPublica Illinois and the Chicago Tribune found the firm helped clients cut over half a billion dollars from property assessments, operating within a system plagued by errors and political influence.

The Barrington property underscores persistent concerns about inequities in Cook County’s property tax system, and Calabrese’s information is expected to heighten scrutiny of both the system and the role of appeal firms.

During Berrios’ tenure as assessor from 2010 to 2018, politically connected firms often secured steep tax breaks for wealthy clients, shifting the burden to homeowners and small businesses in working-class neighborhoods.

Former Illinois House Speaker Michael Madigan, who is set to begin a prison sentence in October after being convicted on bribery charges, built a $40 million fortune largely through property tax appeals handled by his firm, Madigan & Getzendanner.

Though legal, the appeals process fueled a multi-million-dollar industry and drew criticism for favoring the powerful and politically connected.

Sarnoff’s firm recently rebranded as Sarnoff Property Tax and has pledged to continue its aggressive approach on behalf of clients.

“We advocate fiercely for our clients’ interests and seek tax relief at every opportunity,” Sarnoff said in a press release announcing the name change. “Our rebranding reflects our evolution, but our commitment to delivering tax savings remains unchanged.”

Calabrese’s allegations about the Barrington property come after he settled with the county over allegations that he was fired for refusing to leak politically motivated information and for cooperating with the inspector general.

Board of Review Commissioner Samantha Steele flatly denied the allegations, but a separate Inspector General report exposed misconduct noting that she mishandled confidential information and the Board of Review hired politically connected staff without following proper protocols.

Calabrese also pointed out on X that Steele slashed her own property taxes.

"Cook County Board of Review Commissioner Samantha Steele gave herself a $50,000 property tax break—without recusing," he wrote on X. "She shares the Evanston home’s title and mortgage with her boyfriend, Erik Luijten."

Alerts Sign-up

Alerts Sign-up