State Senator. Robert Martwick (D-Chicago) | https://www.ilga.gov/senate/Senator.asp?MemberID=3161

State Senator. Robert Martwick (D-Chicago) | https://www.ilga.gov/senate/Senator.asp?MemberID=3161

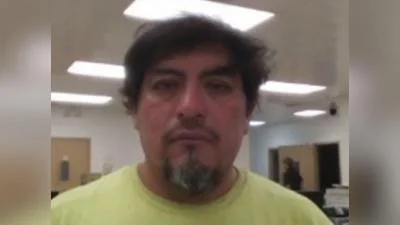

State Sen. Robert Martwick (D-Chicago) is one of the several lawmakers who have personally benefitted from a private school education but considered ditching the Invest In Kids Tax Credit Scholarship program.

He graduated from Loyola Academy in 1984 before going on to Boston College, where he received a B.A. in Economics, and then John Marshall Law School, where he received his law degree. Loyola Academy, which costs $19,250 to be enrolled, serves several qualifying students. The school sends out 90% of its students to four-year universities. Many students at Loyola Academy would not have been able to attend the school without the Invest In Kids Act.

“Students whose household income is below 300% of the federal poverty level ($73,800 for a family of four) are eligible to receive a scholarship," Loyola Academy explained who can benefit from the scholarship. "Prior to April 1, 2019, a priority will be given to students whose household falls below 185% of the federal poverty level ($45,510 for a family of four). It is important to know that this year, over 150 Loyola Academy families had a household income below 300% of the federal poverty level and met the criteria for tax credit scholarships.”

It was called out as a reason to support Invest In Kids by V. Rev. Karl J. Kiser, Provincial of the Midwest Province of the Society of Jesus.

“Loyola Academy and Saint Ignatius College Prep serve a significant number of students who meet the financial qualifications of this scholarship,” Kiser said in defense of Invest In Kids. “Jesuit schools serve both Catholic families seeking a Catholic education for their children, as well as families of other faith traditions who value Jesuit education. Jesuit schools in Illinois perform a public service educating nearly 4700 students formed to be leaders in our Illinois communities. The Invest in Kids Tax Credit Scholarship Program gives families a choice for their children: to attend Jesuit schools that provide a college preparatory, values-based education for the whole child.”

A recent survey conducted by Prairie State Wire revealed Martwick is one of 35 of Illinois' 177 state legislators who attended private high schools. The private high school graduates include 10 Republicans and 25 Democrats, 15 of whom were raised in the City of Chicago.

Missing from the Democrat-led 3,500 pages state budget of $50.5 billion was funding needed to continue the Invest In Kids Tax Credit Scholarship Program. The program allows donors to receive a tax benefit for donating to a state-maintained scholarship program for low-income families for private schools. It serves more than 9,000 K-12 students who are the beneficiaries of the Invest in Kids Tax Credit.

“This is not something that’s been covered by the budget agreement," Gov. Pritzker said at a press conference announcing a budget deal had been struck. "It’s something that still has time, potentially, but it’s not something that’s in the budget agreement.”

Critics highlighted the hypocrisy of lawmakers who agreed to sunset the program. Pritzker and other politicians had sent their children to expensive private schools while denying the same opportunity to less fortunate students. The Wall Street Journal underscored the power dynamics between teachers' unions, Democratic lawmakers, and the failure of the public education system. The decision to shut down the scholarship program disregarded the needs of low-income students but prioritized the interests of unions over educational reform. The main reason behind the opposition to the program was the influence of teachers' unions, with the agenda to terminate it because its popularity highlighted the failures of public schools.

Last year alone, the Invest in Kids program received more than 31,000 applications, signifying a high demand for alternatives to underperforming public schools. Many low-income families, particularly Black and Hispanic, supported the scholarship program because their assigned Illinois schools had low proficiency rates in reading and math. The failure of the public education system was evident from the fourth to eighth grades, leading to a high demand to seek options. However, the unions prioritized their power over student learning and pointed fingers at the schools' failures on lack of funding rather than addressing systemic issues. WSJ reports union leaders hold significant influence over Illinois lawmakers, who have received substantial campaign contributions from teachers' unions.

Alerts Sign-up

Alerts Sign-up