Owner of the Hilton Northbrook paid nearly $5 million in property taxes over the past decade. | Hilton

Owner of the Hilton Northbrook paid nearly $5 million in property taxes over the past decade. | Hilton

The Northbrook Hilton, whose owners are facing a $23 million foreclosure lawsuit, paid more than 20 percent of that in property taxes over the past decade.

The lawsuit was first reported by Crain's.

A review by North Cook News found the owners of the Hilton at 2855 N. Milwaukee Ave in Northbrook paid $4.89 million in property taxes from 2006 to 2015.

The hotel also has $154,000 in unpaid taxes, according to the lawsuit. The Crain's report also said the hotel lost money from 2008 to 2015.

An Illinois Policy Institute report said metro Chicago has the fourth-highest commercial property taxes in the U.S, behind only Detroit, New York and Providence, Rhode Island.

Cook County commercial property taxes are the highest of all.

In comparison, the Hilton Downtown Indianapolis will pay $37,255 in property taxes this year, according to Marion County, Indiana, records.

The Hilton Nashville Downtown had a 2016 property tax bill of $90,375, according to Davidson County, Tennessee, records. The Hilton Garden Inn at Vanderbilt University in Nashville had a bill of $7,508.

The Hilton Downtown St. Louis paid $213,627 according to St. Louis County records.

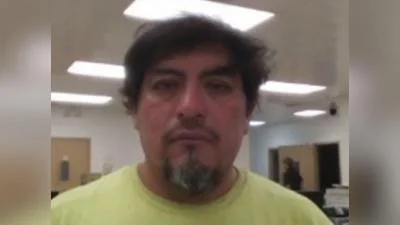

Frank Allgauer of Wadsworth is the lead investor of the Northbrook Hilton. He also owns a Hilton in west suburban Lisle.

---

Lots of room service

The Northbrook Hilton paid nearly $5 million in property taxes since 2006. It now faces a $23 million foreclosure lawsuit.

| Year | Property Tax Paid |

| 2006 | $496,785 |

| 2007 | $518,761 |

| 2008 | $509,717 |

| 2009 | $302,499 |

| 2010 | $426,317 |

| 2011 | $411,458 |

| 2012 | $444,687 |

| 2013 | $630,236 |

| 2014 | $643,877 |

| 2015 | $507,605 |

| TOTAL | $4,891,942 |

Source: Cook County Treasurer

Alerts Sign-up

Alerts Sign-up