Illinois State Rep. Tom Morrison (R-Palatine) fears that the numbers in Gov. J.B. Pritzker’s proposed graduated income tax plan cannot possibly add up the way we are being told they will.

“I’m concerned that if the base numbers for it are based on a static population it can never work,” Morrison told North Cook News. “I mean, if the population is in decline and you see higher income earners leaving the state, that revenue has to be made up and it’s off the backs up people with lower revenues.”

Morrison is not the only one sensing that there seems little chance that Pritzker’s progressive tax will be limited to the state’s most affluent residents, as it has been sold since the governor was still a candidate. Government watchdog website Wirepoints recently revealed the plan as one of deception in which almost everyone will ultimately be forced to dig deeper into their pockets.

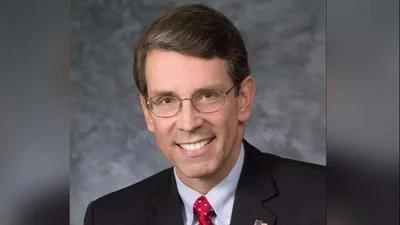

State Rep. Tom Morrison (R-Palatine)

While Pritzker and supporters have promoted it as a surefire solution to Illinois' financial crisis and one sure to reduce property taxes, address pension reform and generate additional funding for the state, Wirepoints begs to differ. For starters, the website estimates the state’s “true hole” to be almost 600 percent greater than the $3.2 billion tabulations formally put forth by the governor’s office.

“I’ve raised the issue with the administration that this could be just another backdoor way of taxing everyone in the state, and I still haven’t gotten a satisfactory answer,” Morrison added. “The worry is that this will come back to hit everyone like so many other tax increases before it have already done."

The progressive tax proposal comes just two years after lawmakers in Springfield banded to override a veto by then-Gov. Bruce Rauner to enact a 32-percent income tax hike, the largest permanent increase in state history.

Alerts Sign-up

Alerts Sign-up