Cook County’s sweetened beverage tax has left behind a sour aftertaste in its first month.

The Illinois Retail Merchants Association (IRMA) is continuing its fight against the 1-cent-per-ounce tax that took effect Aug. 2. The association has filed a lawsuit contesting that the tax violates the Illinois Constitution because it can't be applied universally, which brings challenges and confusion.

“It violates the Uniformity Clause of the Illinois Constitution, which basically says that you have to tax like things alike,” Tanya Trish Daywood, vice president and general counsel of the IRMA, said. “I’ll give you an example: If you go to your local barista and you order a frappuccino that’s got sugar in it or some sort of sugar substitute, that’s actually not taxed. But if you purchase a bottle of frappuccino, that is taxed. It’s essentially the same product. They are both frappuccino; they both have sugar or a sugar substitute; but because one comes in a bottle and the barista makes the other one, that’s the designation that they’ve made on which one is going to be taxed and which one isn’t.”

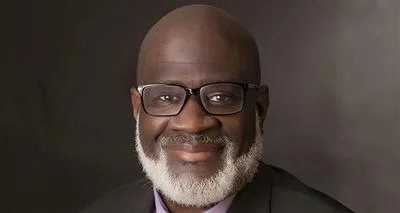

Tanya Trish Daywood, vice president and general counsel of IRMA

IRMA’s suit, filed at the end of June, rejected by a county judge and now in the appeals process, also alleges that the tax is especially troublesome to retailers and businesses because its language is ambiguous.

“The law as it was written is unconstitutionally vague,” Daywood said. “The ordinance says that we are required to roll the sweetened beverage tax into the selling price of the product. But they have issued regulations that have said, ‘Well, you can do that or you can separately state the tax.’ Well, how can you have a regulation that is in complete conflict with the underlying ordinance. Which one are we supposed to follow?”

Another issue that businesses and, most notably, restaurants face is the problem of ice and its effect on the contents of a fountain drink.

“How do you determine how to charge the tax when someone gets a 20-ounce soda from a fountain and they put some ice in it?” Daywood said. “There obviously isn’t 20 ounces of sweetened beverage in that cup, so how do we properly assess the tax?”

All of the problems associated with the tax have presented a huge liability issue for businesses, Daywood maintained.

“As you can imagine, all of the liability falls on the retailer or that restaurateur,” she said. “They obviously can be sued for over- or under-collecting taxes, and we don’t want to be placed on that position. We want very clear and specific regulations on how to apply, the tax and we don’t feel the county has given us that.”

In the past month, the tax has become increasingly unpopular among lawmakers, consumers, retailers and businesses. Some consumers are traveling into neighboring counties to buy sugary drinks.

Republican lawmakers are also seeking to repeal the tax due to its unpopularity.

.jpg)

Alerts Sign-up

Alerts Sign-up