The so-called "privilege tax" on Illinois investment firms that passed the Senate in May but now appears stalled in the House needs to be put out of its -- and our -- misery, the co-host of a Chicago-area radio show said recently.

"Growth is financed by these funds," Pat Hughes, Liberty Justice Center president, said on "Illinois Rising." "This is where capitalists get their money; this is how you do real estate development. This is how you build businesses with this money: equity partnering with debt through the banking system."

Illinois is badly in need of growth and development, which is why taxes on equity and capital gains are so devastating, Hughes said.

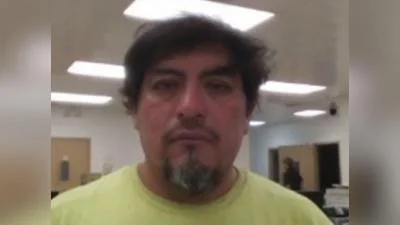

Illinois Rising co-host Pat Hughes

"When you start doing that, it decreases investment, economic expansion does not occur, and you're left in, well, Illinois, I guess is where you're left," Hughes said.

Hughes, a Hinsdale attorney and real estate developer, is also co-founder of the Illinois Opportunity Project. He co-hosts "Illinois Rising" with Illinois Opportunity Project co-founder Dan Proft, a principal of Local Government Information Services, which owns this publication.

The privilege tax bills, SB1719, sponsored by 2018 gubernatorial hopeful Sen. Daniel Biss (D-Evanston), and HB3393, sponsored by Rep. Emanuel Chris Welch (D-Hillside), would levy an additional 20 percent tax against hedge fund and investment management service providers. The bills call the levy "a privilege tax at a rate of 20 percent on partnerships and S corporations engaged in the business of conducting investment management services."

The legislation gained support from the Chicago Teachers Union and others who said it would close a federal loophole that allows the wealthy to not pay about a half-billion dollars in Illinois taxes. The privilege tax would allegedly bring in approximately $473 million to the state, which is more than $200 billion in debt for state and local retirement benefits.

Conservatives and business representatives took a dimmer view of the proposed privilege tax.

Crain's Chicago Business warned that privilege taxes could kill start-ups, while the Illinois Policy Institute called it "poorly thought-out" and said it would tax income that has already been properly taxed, which would be a violation of the U.S. Constitution.

"The reality is, it's a terrible idea," Hughes said.

The tax itself would be paid by the customers of the hedge fund and investment management service providers, but it isn't being sold that way, Hughes said.

"This is the standard Democrat playbook," Hughes said. "What they're saying is, 'Oh, these rich, wealthy financial advisers don't pay their fair share, and we're going to tax them.'"

Proponents of the tax are also banking on constituent ignorance, Hughes said.

"They can sell it to a public that might not be paying close enough attention as, 'We're taxing the 1 percent and giving you the benefit,'" he said.

The bills had success in the spring and looked like they were gaining traction, with HB 3393 passing on a party-line vote out of the House Revenue and Finance Committee on March 23. But then the legislation lost momentum. The Senate bill didn't pass until May 23 and has sat in the House since.

The House version also is still alive, though barely, according to reports.

Alerts Sign-up

Alerts Sign-up